do you have to pay taxes on inheritance in michigan

One way is to gift the. In the United States those who receive gifts are not required to.

Settling Debts In Michigan Probate

The amount of inheritance tax that you will have to pay depends on.

. What is an Inheritance Tax. You need to specify which taxes you are concerned about. Thats because federal law doesnt charge any inheritance taxes on the heir.

Only a handful of states still impose inheritance taxes. Michigan does not have an inheritance tax with one notable exception. New Look At Your Financial Strategy.

In Ireland the threshold is 30000. The 2017 tax reform law raised the federal estate tax exemption considerably. The state in which you reside.

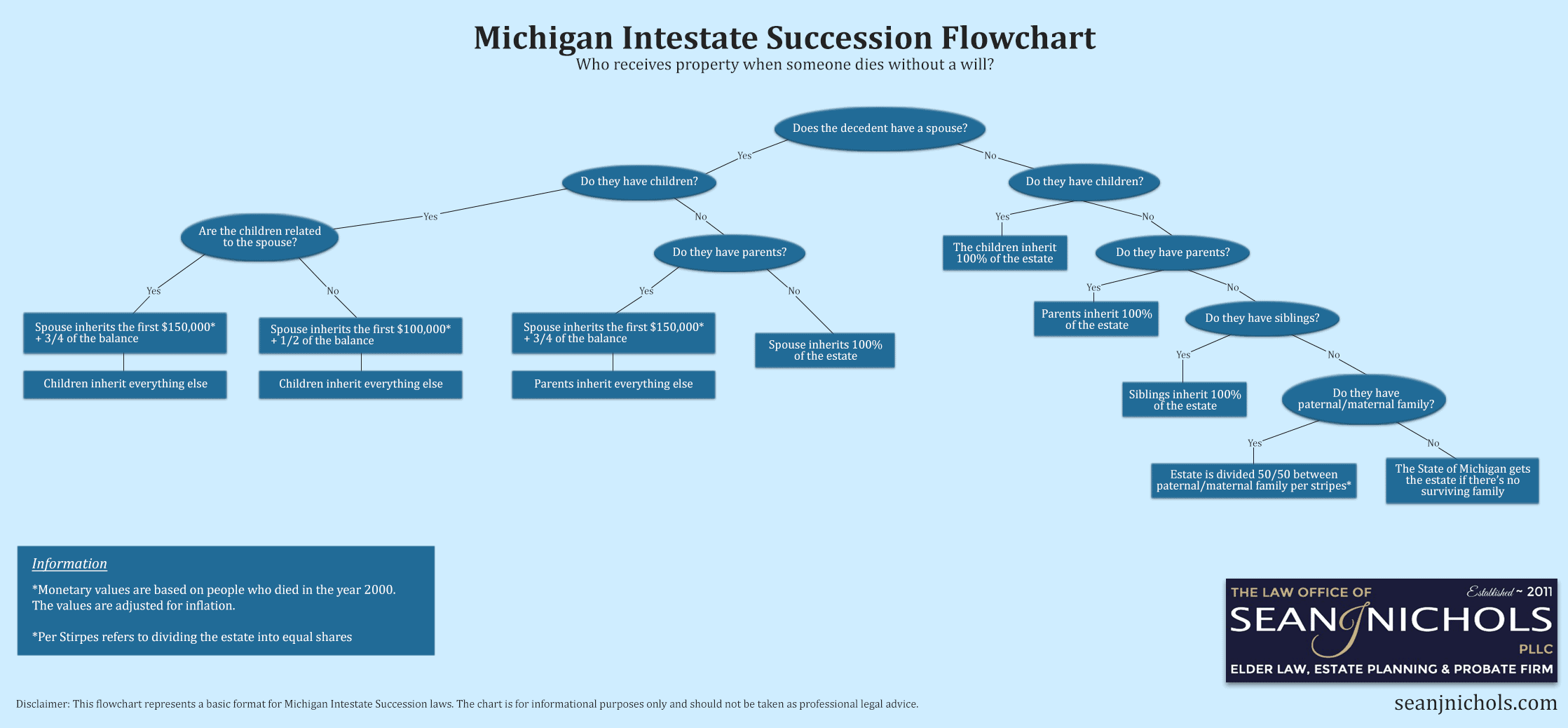

Inheritance tax is levied by state law on an heirs right to receive property from an estate. The size of the inheritance. Michigan no longer has an estate or inheritance tax.

If you receive property in an inheritance you wont owe any federal tax. So you would not need to pay anything for those. Its applied to an estate if the deceased passed on or before Sept.

You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you. Visit The Official Edward Jones Site. If you stand to inherit money in Michigan you should still make sure to check the laws in the state.

Below well go through several key rules to help you determine when you might have to pay taxes on an inheritance. There are a number of ways to avoid paying inheritance tax on property in Ireland. Feb 28 2022 21 min read.

The tax is payable at a rate of 33. Before that law was enacted the exemption was 549. The first rule is simple.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. Like the majority of states Michigan does not have an inheritance tax.

Michigan does not have an inheritance tax. Michigan does not have an inheritance tax. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The State of Michigan does. You may wonder whether you will have to pay taxes on an inheritance you receive from a foreign relative.

Died on or before September 30 1993. Your relationship with the deceased. So youd have to be part of a fairly large trust one with at least 1 million in assets to receive an interest-funded disbursement that would affect your income and tax.

Inheritance Taxation A Treatise On Legacy Succession And Inheritance Taxes Under The Laws Of Arkansas California Colorado Connecticut Delaware Idaho Illinois Iowa Kansas Kentucky Louisian Peter V Ross 9780265142196 Amazon Com Books

How Do State And Local Property Taxes Work Tax Policy Center

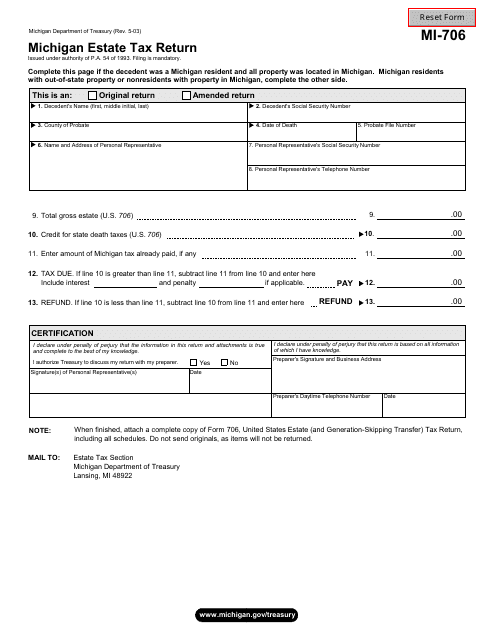

Form Mi 706 Download Fillable Pdf Or Fill Online Michigan Estate Tax Return Michigan Templateroller

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Capital Gains On Inherited Property Smartasset

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Wrongful Death Lawsuit After A Car Accident Faqs

Is Your Inheritance Considered Taxable Income H R Block

Divorce Laws In Michigan 2022 Guide Survive Divorce

Michigan Probate Laws What You Need To Know

Michigan Estate Tax Everything You Need To Know Smartasset

Assets That Pass Outside Of Probate In Michigan Kreis Enderle

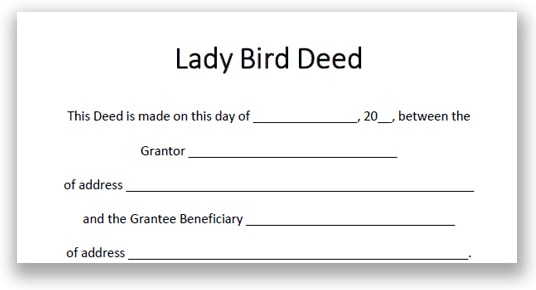

Lady Bird Deed Michigan Quit Claim Deed What To Know

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Choose The Best Michigan Estate Planning Lawyers

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/what-is-probate-3505244-v3-5c07e7f746e0fb0001693ecf-8f024a9ead024bc796f36a02e1880768.jpg)